Tip theft, a concerning issue in the service industry in New York City, involves the improper withholding or distribution of tips that rightfully belong to service workers. This unethical practice not only affects employees’ income but also raises significant legal concerns. For service workers in New York, seeking legal counsel is crucial for safeguarding their earnings and enforcing their rights.

What Is Tip Theft?

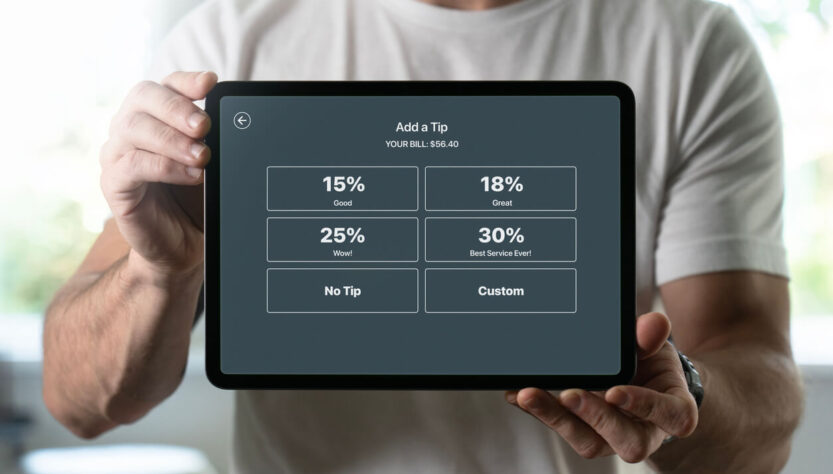

Tip theft involves the unlawful or unethical handling of tips that are meant for service workers. Common forms of tip theft include:

- Employer skimming – illegally taking a share of tips intended for their employees.

- Coercive tip pooling – forcing employees to share their tips with staff who are not typically tipped, like managers or kitchen staff

- Withholding tips – failing to distribute tips or delaying the payment of rightfully earned tips.

Recognizing these forms of tip theft is the first step in taking action against such unethical practices and protecting service industry workers’ right to receive the full compensation they are entitled to.

Legal Protections Against Tip Theft

The federal Fair Labor Standards Act (FLSA) provides baseline protections against tip theft for service workers. The FLSA stipulates that tips are the property of the employee who receives them and explicitly prohibits employers from using an employee’s tips for any reason other than as a credit against their minimum wage obligation (the ‘tip credit’) or in a valid tip pool.

New York Labor Law provides more comprehensive than federal regulations by clearly defining the handling of tips and gratuities, ensuring that they are fully passed on to the employees who earned them. State law also sets stringent rules on tip pooling, specifying who can participate in a tip pool and how tips must be distributed among employees.

These state-specific regulations provide an additional layer of protection for service workers, ensuring their rights are more robustly defended against any form of tip misappropriation.

Employer Responsibilities

Employers in the service industry hold significant responsibilities under both federal and state law when it comes to managing and distributing tips.

First, they must ensure that all tips received by their employees are fully passed on to them, except when a legal tip pooling arrangement is in place. In such cases, employers are responsible for setting up and managing tip pools in a manner that complies with the law, ensuring fair and equitable distribution among eligible staff. Additionally, they are obligated to keep accurate records of all tips received and their distribution, providing transparency and accountability in the process.

Non-compliance can lead to penalties, including fines and reimbursement of withheld tips, as well as potential legal action from employees. It’s crucial for employers to stay informed about the regulations governing tip distribution and to regularly review their practices to ensure they align with legal standards. By fulfilling their responsibilities in managing tips properly, employers not only comply with the law but also foster a fair and respectful work environment, contributing to employee satisfaction and retention.

Reporting Tip Theft

If you suspect you are the victim of tip theft, the first step is to gather evidence. This includes documenting specific instances of suspected theft, such as dates, amounts involved, and any relevant communications with employers or managers. Next, report the issue to your supervisor or the HR department; an internal resolution is often the quickest and most straightforward approach.

If internal reporting does not yield a satisfactory response, seek legal counsel. An attorney knowledgeable in labor law can investigate and advise you on the best course of action, which may include filing an administrative complaint or taking legal action, such as an individual or class-action lawsuit.

One Last Tip

Understanding and effectively addressing tip theft is essential for protecting your rights and your livelihood. By documenting incidents and seeking legal counsel, you can receive all the tips you’ve earned. In a successful claim, you can also recover attorney fees, which means you will have no out-of-pocket legal fees. Talk to an employment lawyer today.